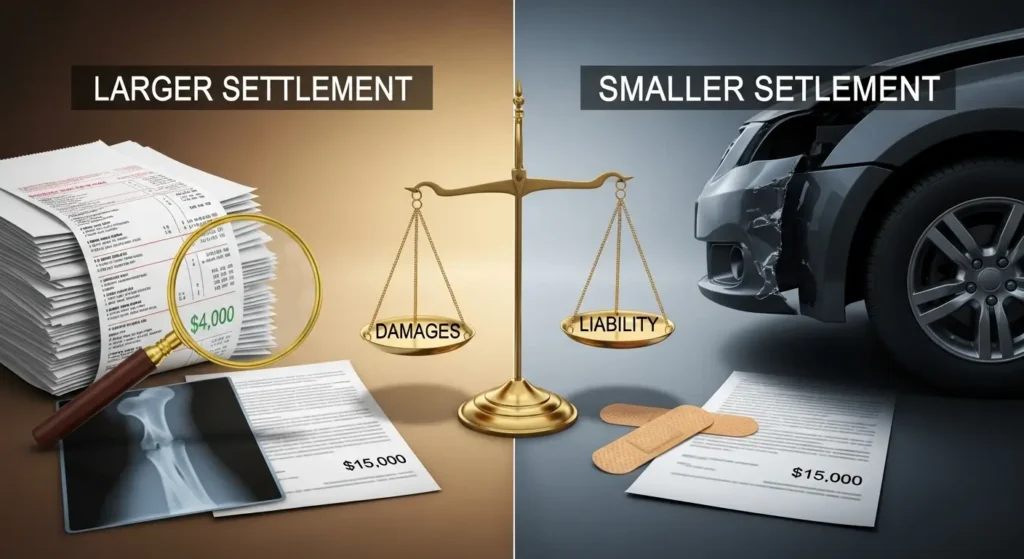

Personal injury settlements can range from a few thousand dollars to millions, leaving many accident victims wondering what determines where their case falls within this enormous range. The difference between a small settlement and a large one often comes down to factors that aren’t immediately obvious to people going through the claims process for the first time.

A personal injury settlement rises or falls based on evidence quality, damage documentation, fault clarity, and the insurance company’s assessment of their litigation risk. Understanding these factors helps accident victims recognize what they can control and what they need professional help to manage effectively.

Smart accident victims understand that settlement amounts depend on both the actual damages suffered and how effectively those damages can be proven and presented during negotiations. The same injuries can result in vastly different settlements depending on how well the case is prepared and presented to insurance companies.

Economic vs. Non-Economic Damages and Building Proof

Medical bills, lost wages, and other economic losses form the foundation of most personal injury settlements because they’re easier to calculate and prove with documentation. These concrete numbers give insurance adjusters starting points for settlement calculations, but the quality and completeness of documentation significantly affects how much insurers will actually pay.

Hospital records, treatment notes, and therapy documentation must clearly link injuries to the accident while showing the full scope of medical care required. Gaps in medical treatment or delayed medical attention can reduce settlement values because insurance companies will argue that injuries weren’t serious or weren’t caused by the accident.

Lost income calculations require proper documentation of pre-accident earnings, time missed from work, and reduced earning capacity for future periods. Self-employed individuals often struggle with these calculations because their income documentation may be less clear than traditional employees with regular paystubs and employment records.

Future medical costs and long-term care needs require expert medical testimony and life care planning that projects ongoing treatment requirements over the victim’s lifetime. These projections can dramatically increase settlement values but require sophisticated medical and economic analysis that most people can’t provide themselves.

Comparative Fault and Credibility Issues

Fault determination affects settlement values dramatically because states with comparative negligence laws reduce settlements based on the victim’s percentage of responsibility for causing the accident. Even small percentages of fault can reduce settlements significantly, making fault determination crucial for maximizing compensation.

Credibility problems arise when accident victims make inconsistent statements, delay medical treatment, or fail to follow prescribed therapy regimens that insurance companies will use to argue against their claims. Social media posts showing physical activities that contradict claimed limitations can devastate settlement values regardless of actual injury severity.

Witness statements and police reports influence credibility assessments by providing independent verification of accident circumstances and injury claims. Strong witness testimony supporting the victim’s account of the accident can overcome insurance company attempts to shift blame or minimize damages.

Pre-existing conditions complicate settlement negotiations because insurance companies will argue that current problems aren’t related to the recent accident but rather to previous injuries or medical conditions. Medical records showing clear differences between pre-accident and post-accident conditions help establish that new injuries resulted from the recent collision.

Policy Limits, Liens, and Negotiation Timing

Insurance policy limits create ceilings on settlement amounts regardless of actual damages, making it crucial to identify all available coverage sources including multiple policies that might apply to a single accident. Underinsured motorist coverage can provide additional compensation when at-fault drivers don’t carry adequate insurance.

Medical liens from health insurance companies, Medicare, or medical providers can consume substantial portions of settlements unless they’re properly negotiated and reduced. These liens often exceed their legal entitlements, but many accident victims don’t understand their rights to challenge and reduce these claims.

Settlement timing affects values because insurance companies often make lowball offers immediately after accidents when victims don’t understand the full extent of their injuries or damages. Rushing to settle before maximum medical improvement is reached almost always results in inadequate compensation for ongoing problems.

Negotiation leverage changes throughout the claims process as evidence develops and legal deadlines approach. Early settlements often undervalue cases because full damages haven’t been established, while settlements near statute of limitations deadlines may be reduced due to time pressure on accident victims.

Conclusion

Settlement values depend on the complex interaction between actual damages and the ability to prove those damages convincingly to insurance companies or juries. The same injury can result in vastly different settlements depending on evidence quality, legal representation, and strategic decision-making throughout the claims process.

Understanding these factors helps accident victims make informed decisions about settlement offers while recognizing when they need professional help to maximize their compensation. Insurance companies know these factors well and use them to minimize settlements when victims don’t understand how the system works.

The formula for maximum settlement value combines proof of damages with strategic pressure applied ethically through credible trial threats and professional negotiation. Smart victims invest in proper case development rather than accepting quick settlements that don’t reflect the true value of their claims.

Source; Pedro Vaz Paulo